How can I access additional funds on my home loan?

Social Media Manager

A redraw facility allows you to access extra repayments that you have made into your home loan. This is beneficial especially when you need additional funds to cover those unexpected costs or contingencies.

Social Media Manager

28 February 2024

5 Minutes

How much redraw do I have?

To find out whether you have redraw funds available and to access online redraw facilities, simply log onto Loan Service Net or call our friendly Customer Service team on 137 377 Monday to Friday from 8:00am to 6:00pm (AEST/AEDT).

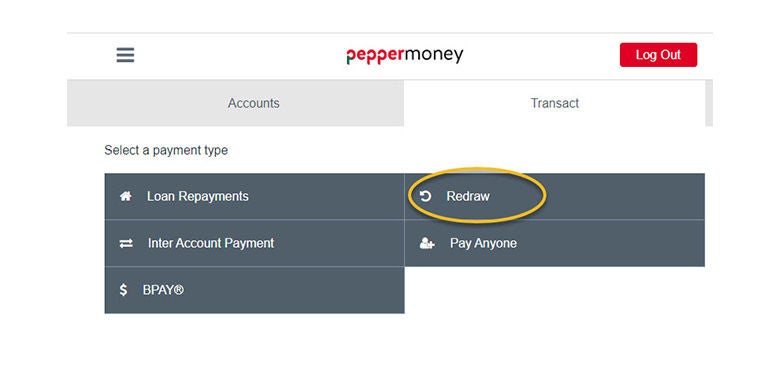

Once you have logged in to LSN as shown below > Go to the 'Transact' tab > Select 'Redraw'

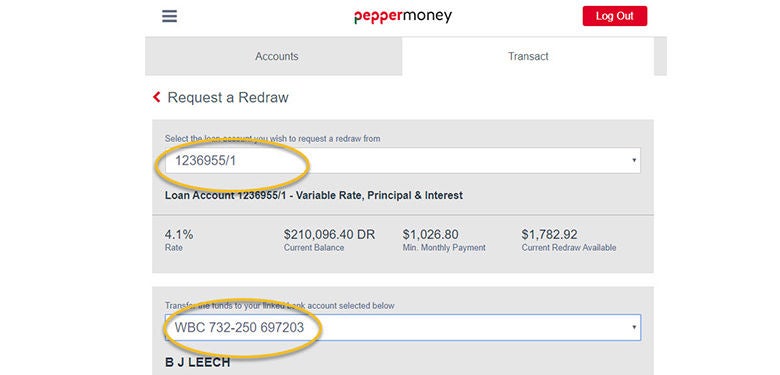

Select the loan account you wish to withdraw a redraw from. Then, select the linked account to transfer these funds to. You can also use Pay Anyone to transfer your available funds to a different account.

You can also request a manual redraw by completing this form and email it to service@pepper.com.au. (Note that a minimum redraw amount of $1,000 applies to manual redraw application).

What are the pros and cons of accessing funds through a redraw?

Pros

- There is no change to the credit limit on your loan

- Your repayment amount is not affected or changed

- You're using your own money

- No impact to credit history

Cons

- Any financial buffer you had built up will decrease

- Your loan balance will increase by the amounts you redraw

- There will be less money available should you require access to these funds in the future

In addition to the redraw facility, you can also access your equity by applying for an Additional Advance.

How do I apply for an Additional Advance?

If you need additional funds, you may be able to borrow more from your existing lender in the form of an Additional Advance. Typically, it will be at a different rate from your existing mortgage.

However, before you consider applying for a further advance, you should make sure that:

- the value of your home has increased significantly beyond the mortgage amount you originally borrowed – this is known as having equity in your property

- you’ve got a good credit record, and you feel comfortable with the additional monthly payments and confident you can afford them

If you’d like to apply for an Additional Advance, call our friendly Customer Service team on 137 377 Monday to Friday 8:00am to 6:00pm (AEST/AEDT) or email service@pepper.com.au for further assistance.

Information provided is factual information only and is not intended to imply any recommendation about any financial product(s) or constitute tax advice. If you require financial or tax advice you should consult a licensed financial or tax adviser.

All applications for credit are subject to credit assessment, eligibility criteria and lending limits. Terms, conditions, fees and charges apply.

The results of the borrowing power calculator are based on information you have provided and is to be used as a guide only. The output of the calculator is subject to the assumptions provided in the calculator (see 'about this calculator') and are subject to change. It does not constitute a quote, pre-qualification, approval for credit or an offer for credit and you should not enter commitments based on it. The interest rates do not reflect true interest rates and the formula used for the purpose of calculating estimated borrowing power is based on the assumption that interest rates remain constant for the chosen loan term. Your borrowing power amount will be different if a full application is submitted and we complete responsible lending assessment. The results in the calculator do not take into account loan setup or establishment fees nor government, statutory or lenders fees, which may be applicable from time to time. Calculator by Widgetworks.

Pepper Money Personal Loans is a brand of Pepper Money Limited. Credit is provided by Now Finance Group Pty Ltd, Australian Credit Licence Number 425142 as agent for NF Finco 2 Pty Limited ACN 164 213 030. Personal information for Pepper Money Personal Loans is collected, used and disclosed in accordance with Pepper’s Privacy Policy & the credit provider’s Privacy Policy.

Pepper Money Limited ABN 55 094 317 665; AFSL and Australian Credit Licence 286655 (“Pepper”). All rights reserved. Pepper is the servicer of home loans provided by Pepper Finance Corporation Limited ABN 51 094 317 647. Pepper Asset Finance Pty Limited ACN 165 183 317 Australian Credit Licence 458899 is the credit provider for asset finance loans.

Pepper and the Pepper Money logo are registered trademarks of Pepper Group Assets (Australia) Pty Limited and are used under licence.