Things you didn't know about credit cards [Infographic]

Credit card interest is costing Australians a lot of money.

We use credit a lot. Australia has a national credit card debt accruing interest of 31 billion.1

Aussies borrowed a collective $29 billion on credit cards over Christmas alone in 2017.1

On an average 55-day interest-free period, December 2017 cost Aussies $230 million in interest.2

Many of us are not as good at managing credit card debt as we think we are.

19% of card holders take longer than three months to service their debt. 5% of this group takes a year or more!2

One-third of Australians pay interest without realising it but the real figure is about double that.3

70.19% of Aussies have a credit card. 20.69% of adults 35-54 have 3 or more!4

Reward programs are not always rewarding for all of us.

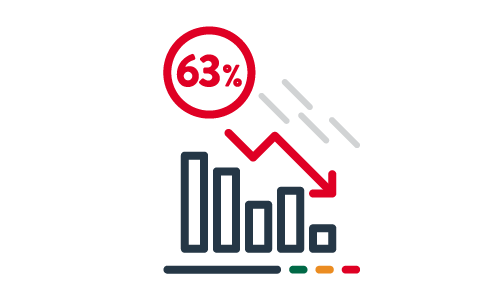

Decreases in credit cards rewards value in the last 12 months in Australia are at around 63%.5

After fees, reward programs deliver little or nothing unless you spend well over $5,000 on your card monthly.5

Cards with reward programs are enticing, but often come with higher fees and above average interest rates.5

With these credit card secrets revealed, be sure to rethink how you’re using them. Remember to always try and pay the balance in full to avoid paying interest on your purchases and check if these annual fees and points gained provide real value.

Sources:

1 http://www.abs.gov.au/ausstats/abs@.nsf/Lookup/4102.0main+features402014#credit

2 https://www.finder.com.au/australians-have-racked-up-29-billion-in-christmas-credit-card-debt

3 http://www.abc.net.au/news/2015-12-16/credit-card-debt-australia/6928326

4 https://www.finder.com.au/credit-cards/credit-card-statistics

5 http://www.smh.com.au/money/borrowing/credit-card-reward-value-falls-63-per-cent-over-past-year-20170831-gy7zun.html

We’re here to help

If you're good at managing your money, and can easily pay the balance off each month - then a credit card could really work for you. But if you struggle to manage multiple credit card debts, a personal loan for debt consolidation may be an option. Learn the pros and cons of consolidating your debts.

To get you started, find out how much your repayments might be, or get your individual rate before applying, in just a few minutes (it won't affect your credit score).

Got a question? Call on 1300 108 794. We're here to help.

Information provided is factual information only and is not intended to imply any recommendation about any financial product(s) or constitute tax advice. If you require financial or tax advice you should consult a licensed financial or tax adviser.

All applications for credit are subject to credit assessment, eligibility criteria and lending limits. Terms, conditions, fees and charges apply.

Pepper Money Personal Loans is a brand of Pepper Money Limited. Credit is provided by Now Finance Group Pty Ltd, Australian Credit Licence Number 425142 as agent for NF Finco 2 Pty Limited ACN 164 213 030. Personal information for Pepper Money Personal Loans is collected, used and disclosed in accordance with Pepper’s Privacy Policy & the credit provider’s Privacy Policy.

Pepper Money Limited ABN 55 094 317 665; AFSL 286655; Australian Credit Licence 286655 (“Pepper”). All rights reserved. Pepper is the servicer of home loans provided by Pepper Finance Corporation Limited ABN 51 094 317 647. Pepper Asset Finance Pty Limited ACN 165 183 317 Australian Credit Licence 458899 is the credit provider for asset finance loans.

Pepper and the Pepper Money logo are registered trademarks of Pepper Group Assets (Australia) Pty Limited and are used under licence.